Buying a house is one of the biggest decisions a person can make, and in the United States, the process can be both exciting and complex. Whether you’re a first-time buyer, a foreign national, or someone moving from another state, it’s important to understand the steps involved. This guide will walk you through how to buy a house in the USA, step by step, using clear and simple English.

Step 1: Understand Your Budget

Before you start looking at houses, you need to understand how much you can afford. Ask yourself:

- How much money do I make each month?

- What are my monthly expenses?

- How much can I save for a down payment?

In the USA, most people borrow money from a bank to buy a house. This loan is called a mortgage. The bank will look at your income, debts, and credit history to decide how much they can lend you.

Helpful terms:

- Down payment: The amount of money you pay upfront, usually 3%–20% of the home’s price.

- Credit score: A number that shows how good you are at paying back loans.

- Pre-approval: A letter from the bank saying how much they are willing to lend you.

Step 2: Get Pre-Approved for a Mortgage

Getting pre-approved shows sellers that you’re serious and ready to buy. To get pre-approved, you’ll need:

- Proof of income (pay stubs or bank statements)

- Proof of employment

- Social Security number (for U.S. citizens)

- Identification (passport or ID)

Once you are pre-approved, you’ll know your budget and can start house-hunting seriously.

Step 3: Find a Real Estate Agent

A real estate agent is a person who helps you find and buy a house. They know the local housing market, understand the paperwork, and negotiate on your behalf. Best of all, in the USA, the seller usually pays the agent’s fee, so having an agent doesn’t cost you extra money.

Ask for recommendations or search online for a licensed and experienced agent. Tell them what kind of house you’re looking for:

- How many bedrooms?

- Do you want a yard?

- Do you want to live near a school or your job?

Step 4: Start House Hunting

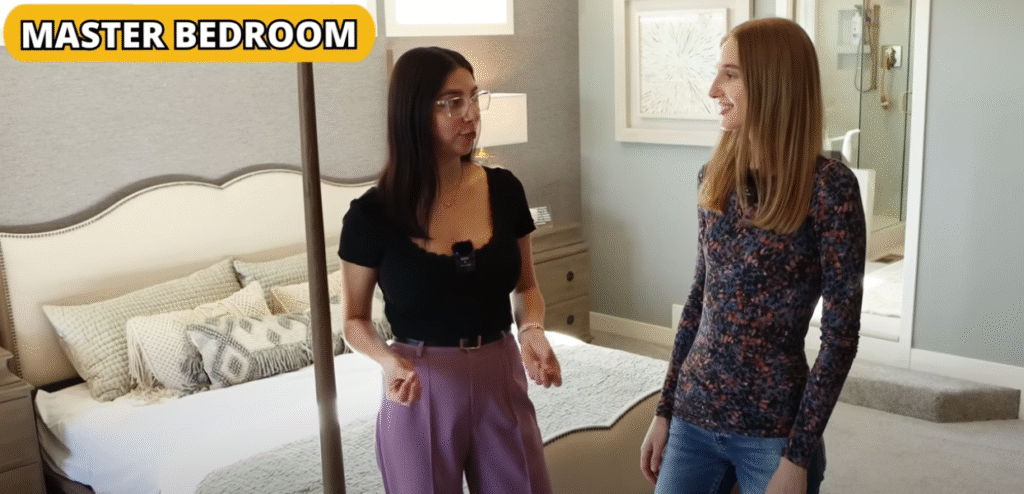

Now the fun begins! Your agent will show you homes that match your needs and budget. When visiting homes, look at:

- The neighborhood (Is it safe? Quiet? Close to stores?)

- The condition of the house (Is it old? Needs repairs?)

- Property taxes (How much will you pay each year?)

- Homeowners association (HOA) fees (if buying a condo or in a private community)

You can also search for homes online using websites like:

- Zillow.com

- Realtor.com

- Redfin.com

When you find a house you love, it’s time to make an offer.

Step 5: Make an Offer

Your real estate agent will help you write an offer letter to the seller. This letter includes:

- How much you’re offering to pay

- Any conditions (like needing a loan or a home inspection)

- A proposed closing date (the day you officially buy the house)

The seller can accept, reject, or negotiate (ask for a better offer). This back-and-forth is called negotiation.

When the seller accepts your offer, you move to the next step.

Step 6: Get a Home Inspection

A home inspection is when a licensed professional checks the house for problems, like:

- Leaking roof

- Plumbing or electrical issues

- Mold or termites

If the inspection finds serious problems, you can:

- Ask the seller to fix them

- Ask for a lower price

- Cancel the deal

A good inspection protects you from buying a home with hidden problems.

Step 7: Finalize the Mortgage

Now it’s time to complete your mortgage with the bank. You’ll choose a mortgage type, such as:

- Fixed-rate: Your interest rate stays the same.

- Adjustable-rate: Your interest rate can go up or down.

You’ll also review all loan terms, such as:

- Interest rate (the cost to borrow money)

- Monthly payment

- Loan length (usually 15 or 30 years)

The bank will then order an appraisal to make sure the home is worth the price you agreed to pay.

Step 8: Close the Deal

This is the final step, called closing. You’ll meet with the seller, your agent, and sometimes a lawyer to sign all the documents. At this meeting, you:

- Sign the mortgage agreement

- Pay the closing costs (2%–5% of the home price)

- Get the keys to your new home!

Congratulations—you now own a house in the USA!

Common English Phrases for Buying a Home

Here are some helpful English phrases you may hear or use:

- “Is this house still on the market?” – Is the home available?

- “I’d like to schedule a showing.” – I want to see the house.

- “Does this home have central air conditioning?”

- “What are the property taxes for this home?”

- “How old is the roof/plumbing/heating system?”

- “I’m interested in making an offer.”

- “We need to include a home inspection contingency.” – Add a condition for inspection.

- “What’s the monthly mortgage payment?”

Tips for Foreign Buyers

If you’re not a U.S. citizen, you can still buy property in the USA. Here are some tips:

- You do not need to be a U.S. resident to buy property.

- You will need a U.S. bank account and may need to apply for an Individual Taxpayer Identification Number (ITIN).

- Some lenders offer mortgages to foreign buyers, but many require a larger down payment, often 30% or more.

- You may be subject to extra taxes or rules depending on the state.

Always work with a real estate agent who has experience helping international clients.

Final Thoughts

Buying a home in the USA can feel overwhelming, especially if English is not your first language. But with the right knowledge and help, you can do it! Remember:

- Know your budget.

- Get pre-approved for a mortgage.

- Find a real estate agent.

- Look for homes that match your needs.

- Make a smart offer.

- Get a home inspection.

- Finalize your mortgage.

- Close the deal and move in!

Buying a home is not just a transaction—it’s a journey. And learning English through this process helps you grow your confidence, your vocabulary, and your future.

🏠💬🇺🇸